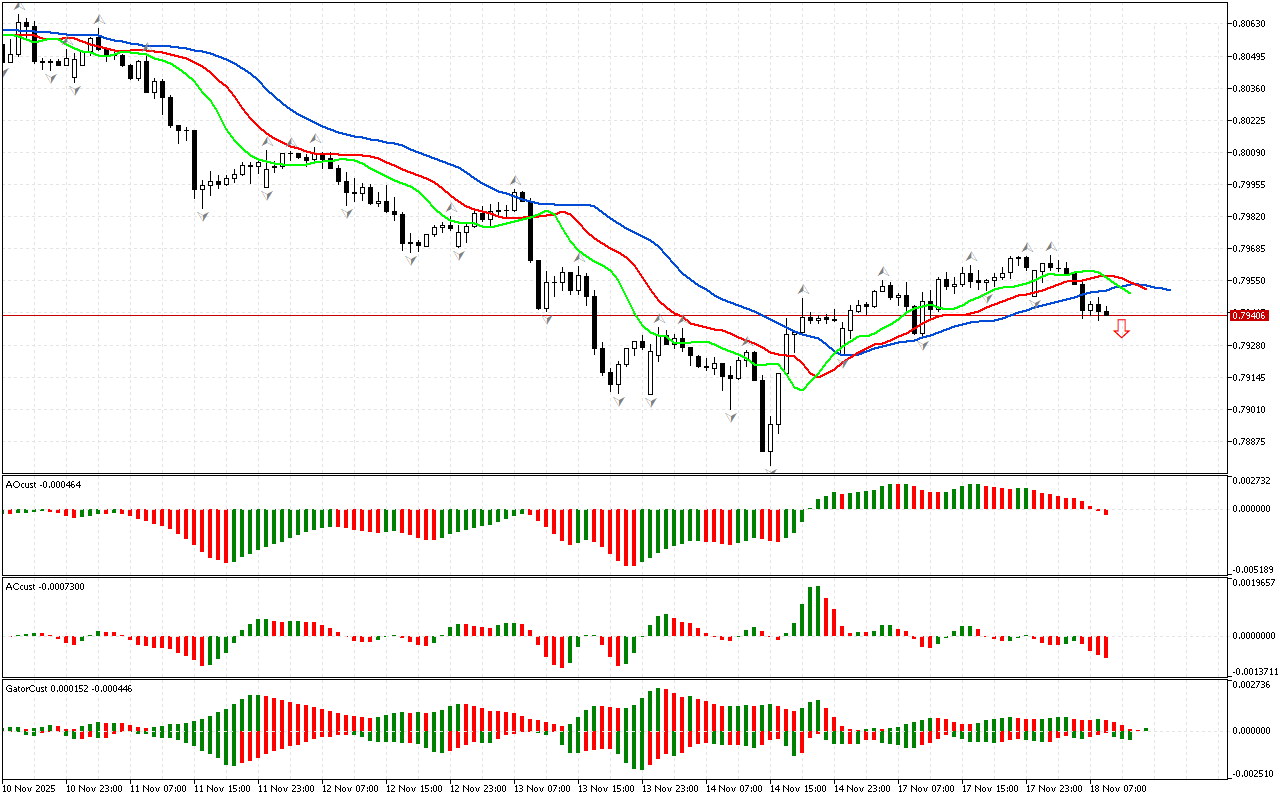

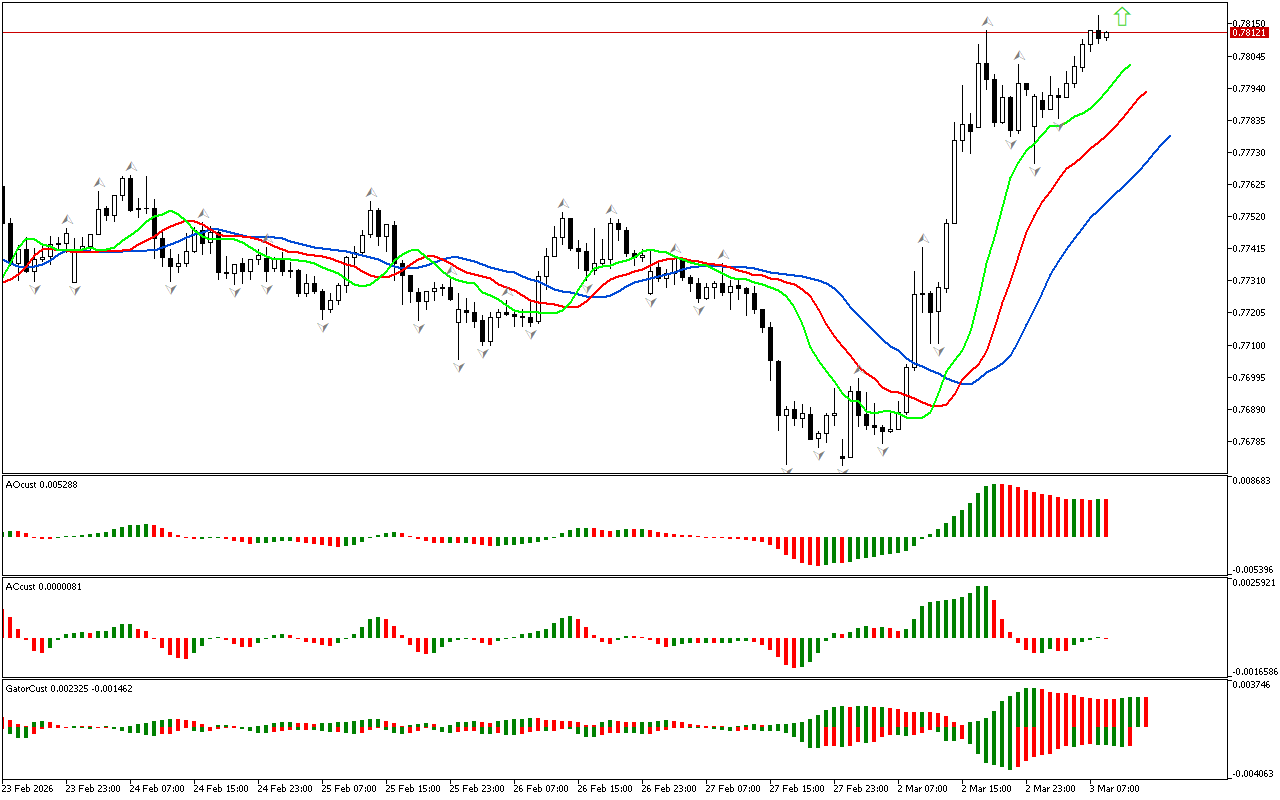

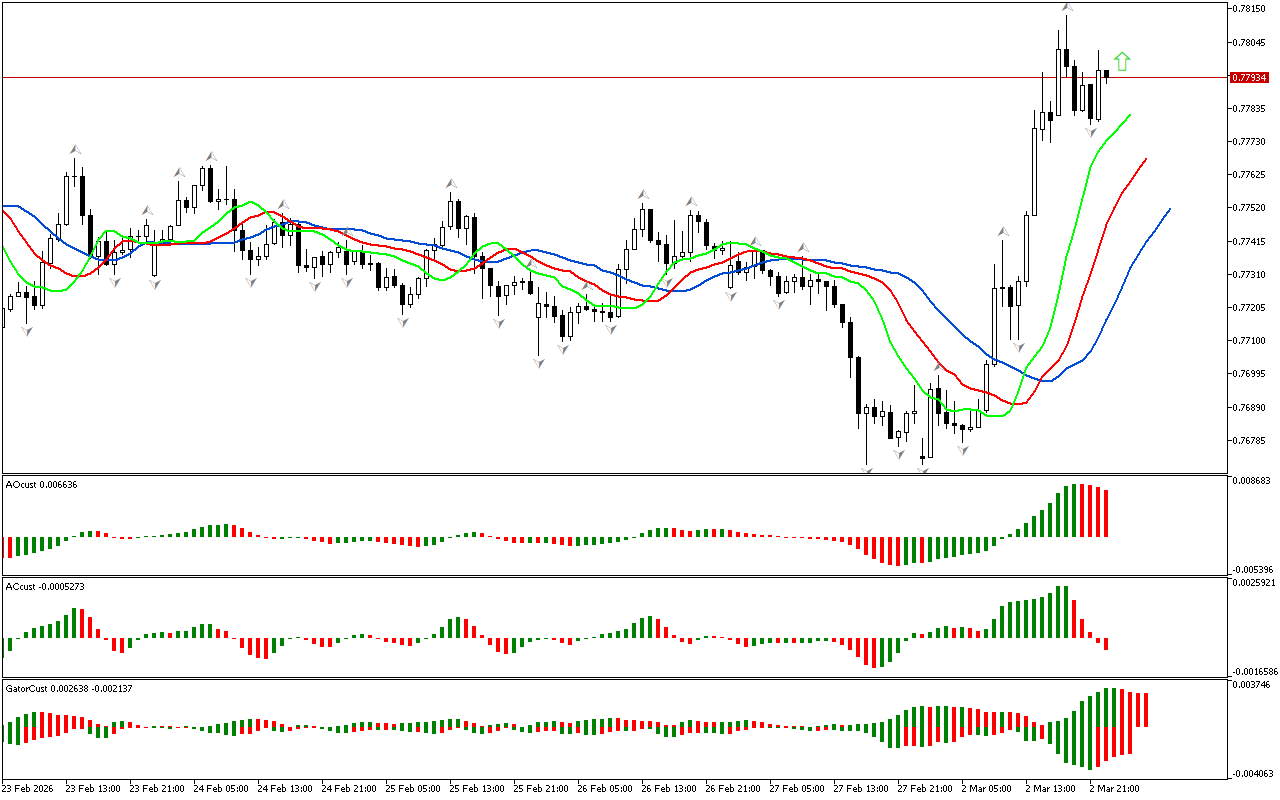

The review of the USDCHF chart traditionally begins with the analysis of the first dimension of the market. The price has fallen below the lower fractal. It means the phase space is defined as southern. Accordingly, now other market dimensions can be examined to assess the opportunities for trading positions opening.

On the chart of the AO indicator, there is the zero line crossing from top to bottom. This is a sign indicating the market has sufficient strength to continue the movement in a southern direction.

The two red bars located below the zero line on the Accelerator Oscillator indicator show an increase in energy in the southern phase of the market.

Signals from the AC and AO indicators indicate that the market has sufficient strength and energy to reduce the price further.

The color of the histograms of the Gator indicator changes, so this indicator has not formed a clear signal yet.

As an epilogue to the analysis, the southern direction of price movement is noted to be considered as a priority. At the same time, the indicators contain signals about the possible development of a correction, which should be used to search for entry points at more beneficial prices.

📊 Sell Stop 0.79382

❌ Stop Loss 0.79486

After entering the market, Stop Loss is moved along the red line after closing each candle. The profit is fixed by moving Stop Loss, or when opposite signals appear on the AO, AC, Gator indicators.

Leave a Reply